dc auto sales tax

Appeal Reconsideration or Motion to Vacate Decisions. Services Bottled Water Delivery Service.

Car Tax By State Usa Manual Car Sales Tax Calculator

The following pages describe and present analysis of the tax rates for the District of Columbia and the revenues generated by these rates.

. The DC DMV Vehicle Registration and Title Fee Estimator is provided to assist District residents in calculating the excise tax registration inspection tag title lien and residential parking fees. The District of Columbia has consumer protection laws. Simply enter the costprice and the sales tax percentage and the DC sales tax calculator will calculate the tax and the final price.

Dc Auto Sales Llc is a corporation in Hollywood Florida. Title 47 Chapter 26. EIN for organizations is sometimes also referred to as taxpayer identification number TIN or FEIN or simply IRS Number.

The system houses individual income business and real property taxes and fees administered by OTR. Groceries prescription drugs and non-prescription drugs are exempt from the District of Columbia sales tax. These changes become effective on February 1 2021.

Thorough research of the vehicle you are considering purchasing including vehicle registration and title histories can be obtained from several companies such as Carfax. Commercial Carriers and Heavy Vehicles. And 145 for hotels and transient accommodations.

Please note state sales tax rate might change and the default sales. The Office of Tax and Revenue OTR reminds taxpayers of services that will be required to collect the Districts 575 percent Sales and Use tax effective October 1 2014. The updated excise tax rates will take into account the fuel efficiency of motor vehicles as mandated by Title V of the CleanEnergy DC Omnibus amendment Act of 2018.

Exact tax amount may vary for different items. Issuance of every original and subsequent certificate of title on motor vehicles and trailers. District of Columbia has a statewide sales tax rate of 6 which has been in place since 1949.

The District of Columbia collects a 6 state sales tax rate on the purchase of all vehicles that weigh under 3499 pounds. If EITC is applied to the excise tax documentation from the Office of Tax and Revenue OTR will be required prior to vehicle titling. DC DMV Dealer Services.

The District of Columbia state sales tax rate is 575 and the average DC sales tax after local surtaxes is 575. Do not file an amended sales tax return for a refund of sales tax - use Form FR-331 to claim a refund. About MyTaxDCgov MyTaxDCgov is the Office of Tax and Revenues OTR online tax system.

Consequently sales tax burdens in DC were lower than the 50-city average at all five income levels. 20 on policy and membership fees and net premium receipts. Dc Auto Sales Llc is incorporated in Florida and the latest report filing was done in 2020.

60 - Tickets to legitimate theaters and entertainment venues. 100 electric vehicles are exempt from the vehicle excise tax. Do not use the sales tax forms to report and pay the gross receipts tax.

DC DMV knows that buying and selling a vehicle can be a difficult process. DC has a sales tax rate structure that also includes a 10 rate for liquor sold for off-premise and on-premise consumption restaurant meals and rental vehicles. Find your state below to determine the total cost of your new car including the car tax.

The employer identification number EIN for Dc Auto Sales Llc is 460750872. Individual Income Taxes and Business Taxes. Make sure that the tax identification number is correct and complete.

2022 District of Columbia state sales tax. Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees. As a result of recent regulatory changes DC DMV has revised the calculations for motor vehicle excise taxes.

Request Reconsideration after Contesting. Current Tax Rate s The rate structure for sales and use tax that is presently in effect. We have assembled the following information and tips to assist youand to make sure your transaction is safe and legal whether you are the buyer or the seller.

The sale by a bottled water delivery service of bottled water by the gallon generally for use with and to be dispensed from a. Unlike many other states District of Columbia doesnt allow municipal governments to collect a local option sales tax. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator.

For private sales you should also obtain a bill of sale. Sales and Use Taxes. A tax rate of 7 is charged if the vehicle weighs between 3500 and 4999 pounds and 8 is charged for vehicles that weigh at least 5000 pounds.

Sales and Use Tax Table at. 80 - Sales and use tax on soft drinks. Additional information about the various components which make up the registration and title fees can be found at the links below.

The Districts general sales tax of six percent is the fourth lowest of the rates in all 51 cities the same as six other jurisdictions having the same rate when looking at total state and local sales tax rates combined. Make sure you know whether the vehicles sales price includes the Districts excise tax. 10 hours agoApple is banning Russian-state-controlled news apps RT and Sputnik from its app store.

The DC sales tax calculator has the option to include tax in the gross price as well as the amount to be added to net price. Businesses must use Form FR-800 to report and pay a sales and use tax liability - do not use Form FR-329. Multi-Vehicle Fleet Ticket Service.

20 percent on health insurance premimiums and HMOs the 03 percent increase will go into the Healthy DC Fund. Therefore sales tax rates will be the same across the entire state. It represents the many ways that OTR is at the forefront of.

18 rate for parking in commercial lots. On March 1 Apple confirmed that it had banned apps for Russian-state-controlled media outlets Russia Today. DC Government accepts VISA MasterCard American Express and.

Admit with an Explanation. Motor Vehicle Excise Tax. Buying and Selling a Vehicle.

60 - General rate for tangible personal property and selected services.

What S The Car Sales Tax In Each State Find The Best Car Price

States With No Sales Tax On Cars

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

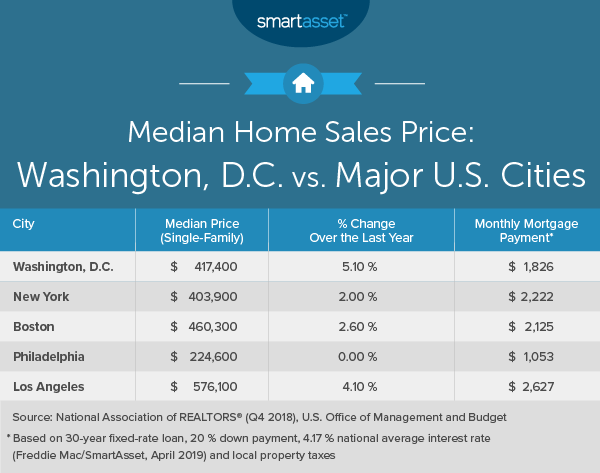

The Cost Of Living In Washington D C Smartasset

Which U S States Charge Property Taxes For Cars Mansion Global

Gene Messer Kia Lubbock Kia Dealership Service Center

How A Speeding Ticket Impacts Your Insurance In Washington D C Bankrate

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Dc Motors Used Cars Northwood Oh Used Bhph Cars Oregon Oh Bad Credit Car Dealer Northwood Oh Pre Owned Bhph Autos Oregon Oh Previously Owned Vehicles Northwood Oh Used Suvs Oregon Oh Used Bhph Trucks Northwood Oh Used

Nj Car Sales Tax Everything You Need To Know

Car Tax By State Usa Manual Car Sales Tax Calculator

What You Need To Know About Vehicle Registration In Dc

How Do State And Local Sales Taxes Work Tax Policy Center

Car Tax By State Usa Manual Car Sales Tax Calculator

District Of Columbia Sales Tax Small Business Guide Truic

Virginia Sales Tax On Cars Everything You Need To Know

States With Highest And Lowest Sales Tax Rates

Can I Avoid Paying Sales Taxes On Used Cars Phil Long Dealerships